Square Credit Card Processing for Dummies

Wiki Article

5 Easy Facts About Payment Solutions Shown

Table of Contents5 Simple Techniques For Clover GoThe Buzz on Payment SolutionsNot known Details About Virtual Terminal Some Of Virtual TerminalSome Known Questions About Payeezy Gateway.Payeezy Gateway for DummiesThe Ultimate Guide To Credit Card ProcessingFascination About Credit Card ProcessingMerchant Services for Beginners

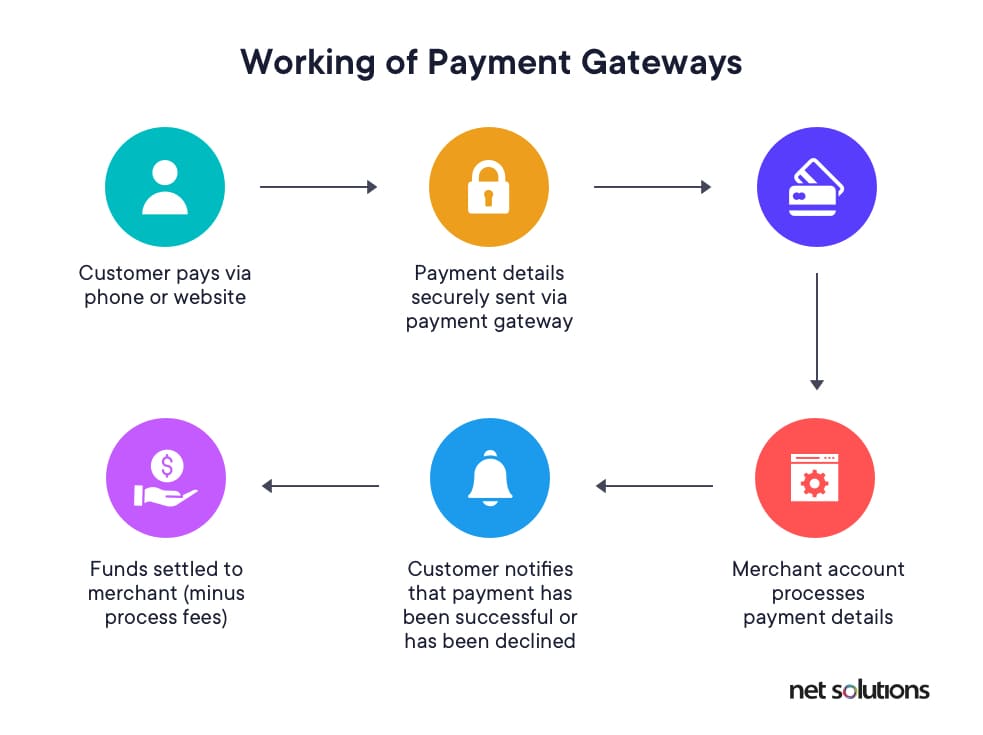

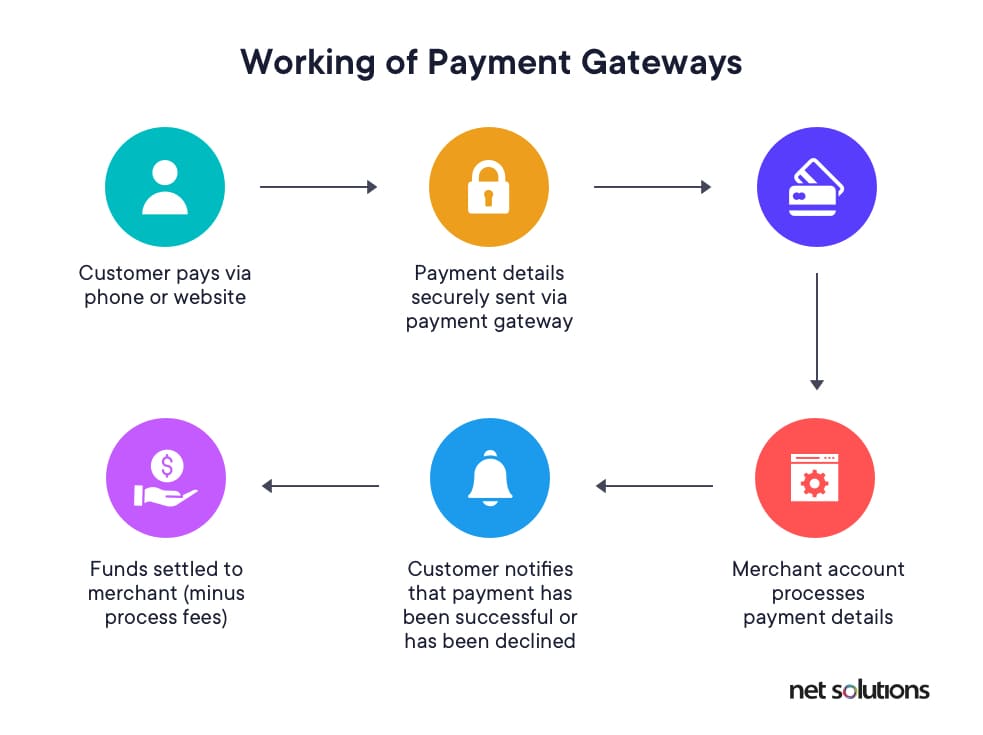

One of the most common complaint for a chargeback is that the cardholder can not remember the transaction. The chargeback ratio is really reduced for deals in a face-to-face (POS) environment. See Chargeback Monitoring.You do not need to become a specialist, yet you'll be a better customer if you know how bank card processing really works. To understand just how the settlement process jobs, we'll consider the actors and their duties. Who are the stars in a credit and debit card purchases? acquires a credit history or debit card from an uses the account to spend for items or services.

The Main Principles Of Comdata Payment Solutions

That's the credit scores card process in a nutshell. The costs the account for the quantity of the transactions. The after that transfers suitable funds for the deals to the, minus interchange charges.

More About Comdata Payment Solutions

You can get a merchant account through a repayment handling company, an independent professional, or a big financial institution. A repayment handling company or monetary organization takes care of the purchases between your consumers' banks and also your financial institution.You need to allow merchants to gain access to info from the backend so they can check out background of payments, cancellations, as well as various other transaction data. Also, you have to comply with the PCI Security Specifications to supply site repayment handling services for customers. PCI Security assists vendors, merchants, and also banks apply standards for producing secure repayment remedies.

All about Credit Card Processing

Pay, Buddy, for instance, is not subject to banking laws, so it can freeze your account as well as as a result your money at will (virtual terminal). Other disadvantages consist of high prices for some types of settlement processing, constraints on the number of deals daily and quantity per transaction, as well as security holes. There's also a selection of on-line repayment handling software application (i.

The Credit Card Processing Companies Statements

seller accounts, occasionally with a settlement portal). These systems differ in their commissions and assimilation opportunities click some software is much better for accountancy while some fits fleet administration best. Another selection is an open resource payment handling platform. Do not believe of this as free processing. An open source system still needs to be PCI-compliant (which sets you back around $20k each year); you'll have to release it and preserve several nodes; and you'll need to establish a partnership with an obtaining bank or a settlement processor.The Only Guide for Payment Hub

They can also make your money flow much more foreseeable, which is something that every small company proprietor pursues. Figure out more just how around B2B settlements function, and also which are the best B2B payment products for your small company. B2B payments are settlements made in between 2 sellers for goods or solutions.

Excitement About Credit Card Processing Companies

People entailed: There are numerous people included with each B2B transaction, consisting of receivables, accounts payable, billing, and procurement teams. Settlement hold-up: When you pay a pal or relative find more info for something, it's commonly best on-site (e. g. at the dining establishment if you're breaking an expense) or just a few hrs after the occasion.Due to the complexity of B2B settlements, an increasing number of organizations are selecting trackable, digital repayment options. Fifty-one percent of organizations still pay by check, decreasing from 81% in 2004. And also 44% of companies still obtain repayment by check, declining from 75% in 2004. There are five main means to send and also receive B2B settlements: Checks This category consists of traditional paper checks as well as digital checks issued by a customer to a seller.

The Ultimate Guide To Virtual Terminal

Digital bank transfers These are repayments between financial institutions that are routed with the Automated Cleaning Residence (ACH). This is one of the safest and reputable payment systems, yet financial institution transfers take a few days much longer than cord transfers.Each option varies in simplicity of use for the sender as well as recipient, price, and also safety and security. That said, a lot of businesses are changing away from paper checks and also relocating towards electronic and also digital repayments.

Payment Hub for Dummies

Settlements software and also apps have records that provide you an overview of your receivables and accounts payable. If there a few sellers that consistently pay you late, you can either implement stricter deadlines or quit functioning with them. B2B settlement solutions also make it much easier for your clients to pay you, helping you receive settlement much faster.Report this wiki page